Israel touts tax breaks to help first-time home buyers

To make it easier for young couples to buy their first apartment and get on to the housing ladder, changes are being made to the taxation system to reduce the costs of buying a first property.

Earlier this month, the Ministerial Committee for Legislative Affairs approved a series of amendments which include raising the ceiling for paying purchase tax from NIS 1,805,000 ($567,306) to NIS 1,930,000 ($606,593).

The move is designed to reduce the costs associated with a first purchase as amounts below this level are free of the purchase tax. The move applies specifically to Israeli first-time buyers, and aims to continue the trend of cooling demand from investors (households that own two or more homes) for Israeli property.

It also aims to cool demand from foreign buyers, who will not receive the same favorable incentives as Israeli buyers.

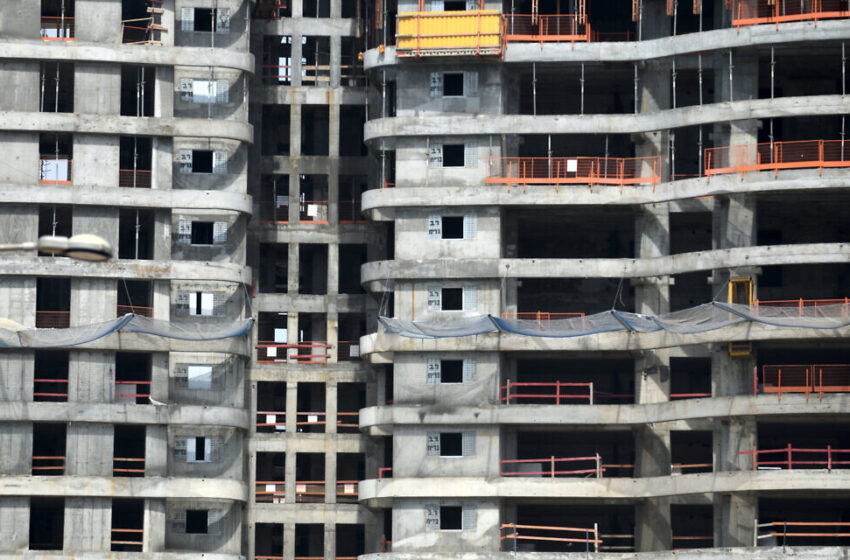

At the same time, the committee agreed to a package of tax benefits for private owners willing to designate land for residential construction and to exercise building rights within a short time frame.

Landowners who hold on to empty land will be forced to pay significantly more in tax. The aim of this legislation is to encourage the development of private land for residential use, to help to increase the supply of housing units in the short to medium term.

These incentives complement moves that have already been announced to encourage redevelopment of urban centers, and to encourage the Israel Land Authority to release more land for residential development.

Finance Minister Avigdor Liberman has said consistently that the best way to control housing price rises is to find ways to increase the supply of housing units that are available as primary homes rather than investment properties.